Dear reader,

We've been slowly ramping up our Algeria coverage. It's a discreet ecosystem, receiving nowhere near the attention Nigeria, Egypt, South Africa, or Kenya enjoy.

You probably expect me to say "despite the little attention, something is brewing". It is. The extent of such 'brewing' is hard to decipher as an outsider. So we do what the RO always does: speak to insiders.

A few months ago we spoke to Ramy Zemmouchi, publishing a deep-dive on the Algerian ecosystem's history and an explanation of notable, recent legislative changes. For example:

"It just became way easier to create a VC or PE fund in Algeria, thanks to a new funding vehicle called a fonds commun de placement à risque (FCPR). This allows investors in a fund to be dissociated from its day-to-day operations, replicating the classic “GP/LP” fund structure."

Excerpt from Dissecting Algeria's discreet startup scene, originally published in The Realistic Optimist

The next challenge is getting local capital to bet on the Algerian VC asset class (still largely unproven, exit-wise).

When it comes to fundraising, Algerian founders are often stuck between two dilemmas. On the one hand, foreign capital is hard to mobilize due to the ecosystem's youth and informational opacity. On the other hand, local capital generally prefers safer investments in real estate.

The notable exception is Yassir, a ride-hailing app which raised a $150M Series B. But most local founders don't have the background nor the Silicon Valley networks Yassir founder Noureddine Tayebi boasts. That makes it a hard proxy to relate to.

Algerian founders are left with the unglamorous option of building an income-generating business. And if they're aiming for VC-scale, one which serves an Algerian problem that also exists in other markets.

That's the case for temtem.

Founded by Kamel Haddar, temtem serves the Algerian retail sector. The sector is fragmented, in part because modern trade (ie: supermarkets) accounts for a minuscule fraction (~3%) of annual turnover. The crushing majority of Algerian retail flows through independent, small retailers.

temtem views the retail sector through an ecosystem lens. You have the retailers, the consumers, and the FMCG brands. temtem believes these three parties have overlapping interests. By serving one, temtem can serve another.

For example:

- Consumers want loyalty programs and rewards when shopping.

- FMCG brands want more ROI visibility on their marketing campaigns.

How can both problems be symbiotically solved, via the same product?

Temtem's answer:

- Build a feature whereby consumers take a picture of their receipt and upload it to the temtem app.

- In exchange, they receive cashback on specific brands.

- The FMCG brand gains granular sales data, which they can cross-reference with marketing campaigns they've been running. They can extrapolate an ROI from there.

This is just one example. Temtem's product playbook replicates this ethos at scale. Build products that, by serving the interests of one party, also serve the interests of another.

From a more macro point of view, Kamel is surprised as to why Algeria gets so little foreign VC funding. To him, Algeria's market conditions are better than other African countries where VC are plowing money.

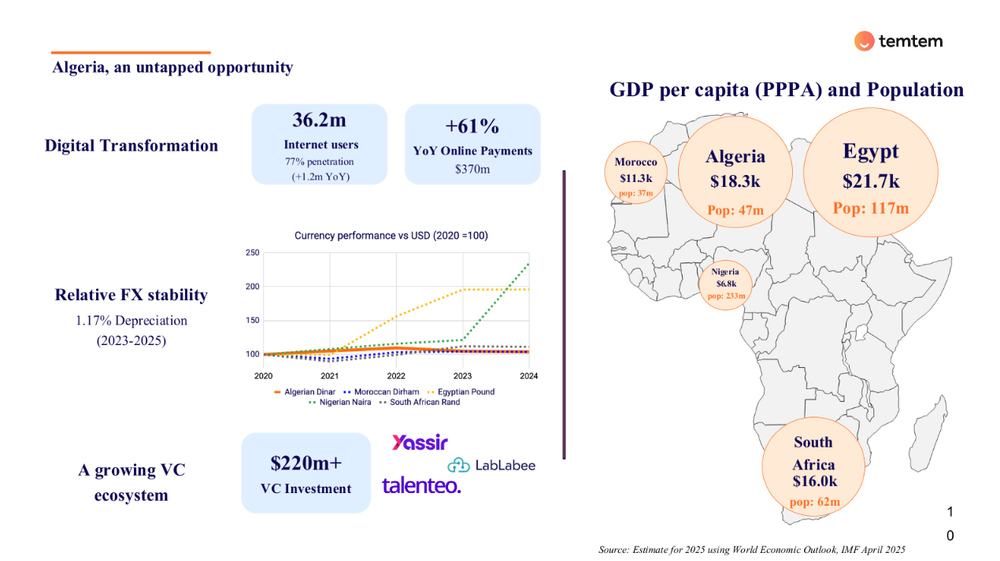

Here's an internal slide he shared to prove his point:

temtem claims impressive traction:

- 1 million users.

- 20,000 retailers.

- Over 5 millions receipts pictured and uploaded to the app.

The Realistic Optimist recently published a 2,500+ word interview with Kamel. We spoke about:

1) Why temtem pivoted away from ride-hailing.

2) A precise explanation of temtem's business model (and various products).

3) How to engineer a competitive response to create demand, rather than waiting for an illusive "snowball effect".

4) What recent changes in Algeria's fintech regulations mean for temtem.

5) What outsiders misunderstand about the Algerian market.

6) How temtem strategizes its international expansion.

.... among other topics.

The full article is available for paid RO subscribers only. You can grab one (€9/month) right below. A paid subscription unlock our entire library (100+ articles), as well as new weekly articles straight to your inbox.

Paid subscribers; please enjoy the full interview below.