"The Filipino startup ecosystem was shielded from the 2022 funding drop"

An exclusive interview with Franco Varona, managing partner at Foxmont Capital, a top-tier Filipino VC

The Realistic Optimist provides weekly, in-depth analyses of some of the most relevant stories in our now-globalized startup world. Subscribe below to receive it directly to your inbox and don’t hesitate to share it with your colleagues :)

Franco Varona: a primer

Leads Foxmont Capital Partners, one of the Philippines’ leading venture capital firms (and the country’s first independent VC)

Worked at Grab, a Singaporean unicorn, during which he built the company’s Filipino operations from the ground up

Has been running GMI Post, a media agency that develops country and thematic reports, for the past 15 years. GMI’s reports have been used by leading publications such as Foreign Affairs, The Japan Times, Forbes Magazine, and Forbes Asia.

Before diving into this interview, feel free to refresh your memory by reading my article on the Filipino startup ecosystem.

The Filipino startup ecosystem had a late start compared to some of its neighbors. Why is that?

I think that a startup ecosystem can only truly take off once local, independent VCs are in place. In the Philippines, the establishment of such VCs (Foxmont being the first of them) happened a little later than in neighboring countries such as Indonesia. I think Indonesians just understood this earlier than the rest of the region.

The reason I make this point is the following: in Asia, an overwhelming amount of available VC money is centralized in Singapore, the region’s financial hub. Without local independent VCs in surrounding countries, Singapore-based teams would have to build out local operations and rely on their local network for each Asian country they want to invest in. That’s a feat many of them don’t have the manpower to do. Asian countries that lack a competent VC industry thus get left out of the bulk of regional VC money.

One might retort that Asian startup ecosystems, even nascent ones, benefit from strong corporate involvement and that regional VCs could lean on them. In the Philippines, corporate-backed Kickstart Ventures did indeed contribute to boosting the ecosystem.

However, corporate venture capital (CVC) is a truly different animal, making co-investment between them and traditional VCs difficult due to potentially differing strategic objectives. Thailand’s ecosystem, which has vigorous corporate VC activity but struggles to make a name for itself internationally, is a case in point.

Learn more about Thailand’s corporate/startup conundrum

The pandemic had a truly transformative effect on the Filipino ecosystem, more so than in other countries. Why?

Before the pandemic, the Philippines was mainly analog. Long lines at the ATM on payday were a common occurrence. Cash was very much predominant.

Now imagine that same cash-based society being forced indoors. The Philippines had one of the world’s strictest lockdowns, flipping long-held societal features on their heads. This new paradigm led to extremely rapid digitization of the country’s economy, exemplified by the increased use of wallets such as GCash and Maya. Between 2020 and 2021, the adoption of digital wallets increased by 187%, onboarding approximately 41 million additional people.

This digitization of money laid the foundations for the startup ecosystem to take off. Without digital payment methods, tech startups simply cannot function. Each additional person using digital payments is a new potential user of a startup’s product. Following that logic, it would mean that the market for Filipino startups grew 187% in just a year. No wonder the ecosystem flourished!

Global VC funding hit all-time highs in 2021, in part due to the economic digitization you described. Some ecosystems have ended up suffering from it. How has the Filipino ecosystem fared in that aspect?

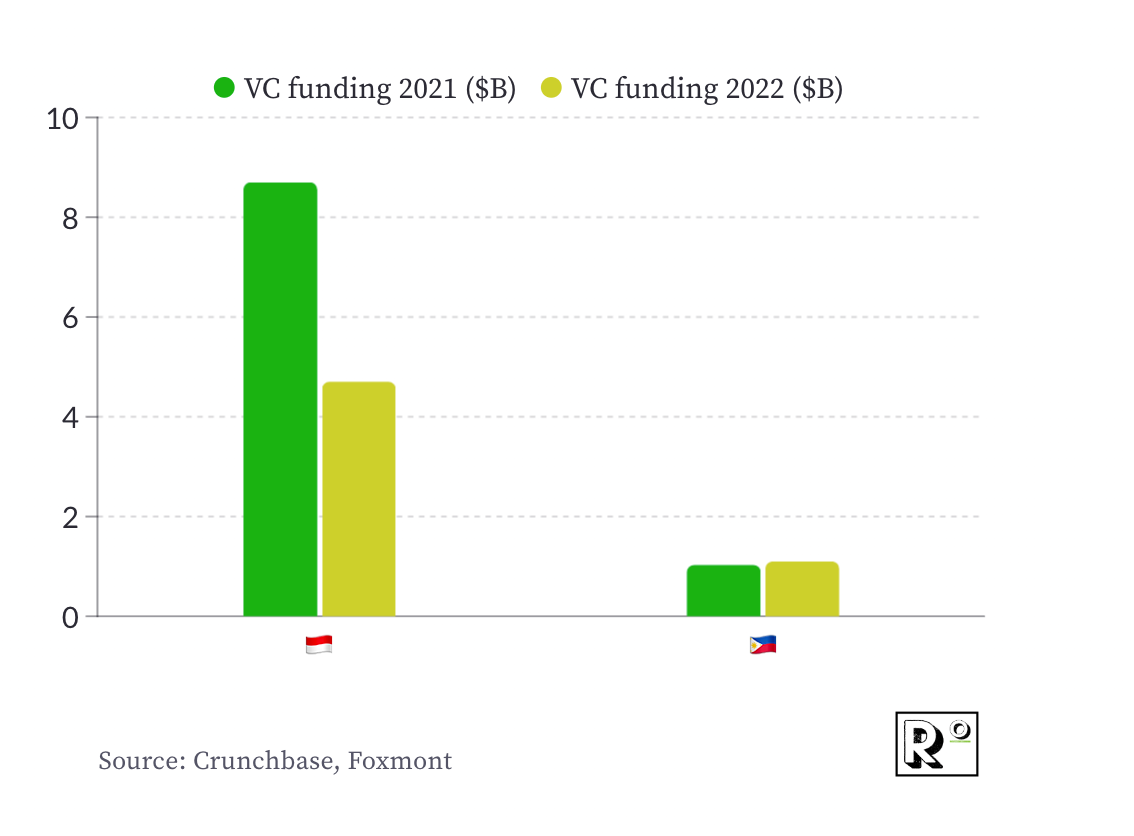

Filipino startup funding did drastically increase from 2020 to 2021, jumping from $440M to $1.03B. However, the ecosystem never seemed to be “overheating”. Since the Philippines was traditionally an investor’s “alternative choice” when looking at Asia (behind Singapore and Indonesia), we were somewhat shielded from the funding fury that has hurt other ecosystems, such as Pakistan.

Read how a leading Pakistani VC explains her country’s funding drop

Since no one was truly fighting over Filipino deals, the ecosystem got to keep relatively reasonable valuations. Unlike other ecosystems, VC funding in the ecosystem didn’t drop in 2022. It’s far from the explosive growth we’ve seen before, but the ecosystem is growing year over year. Although we are still way behind Indonesia in aggregate funding, our trend is looking upward.

More encouraging in my opinion is the increased share of regional VC funding we are taking up. In 2021, the Philippines took 5% of regional VC funding. In 2022, that number increased to 9%.

You grew up in Canada, and went to school in the US. What is the impact returning Filipinos from the diaspora have had on the ecosystem?

It’s no secret that in many emerging markets, the first wave of startup founders are often diasporas returning from abroad. In Asia, they’re often referred to as “sea turtles”.

Even at Foxmont, most of the first wave of founders we funded were sea turtles (or former Rocket Internet employees with operational experience in the Philippines). Sea turtles bring a network, knowledge, and experience that is essential to building out the ecosystem’s foundations and best practices.

What’s exciting to see recently has been the emergence of the “second-generation” Filipino startup founders, born and bred in the Philippines. These founders bring a different skill set to the table, most prominently their deep, intricate understanding of the local problems they’re trying to solve.

Talking about talent: is the ecosystem managing to attract the best, young gems?

For educated Filipinos, there is still a cornelian choice between the traditional corporate route and the startup one. For many, money hasn't been easy to come by and the promise of a stable, high-paying job at a multinational continues to be alluring.

Culture also plays a role: Filipino society is conservative, and risk-taking isn’t necessarily seen as a virtue. Social stigma about the entrepreneurial/startup path is still a reality.

However, I do feel that the tide is shifting: as the ecosystem grows and startups become more present in the country’s economic makeup, the startup path will grow in legitimacy. A better understanding of stock options and their potential financial upside is contributing to making the sector more and more attractive.

You say that the Philippines is a “consumption-driven” economy. What do you mean by that?

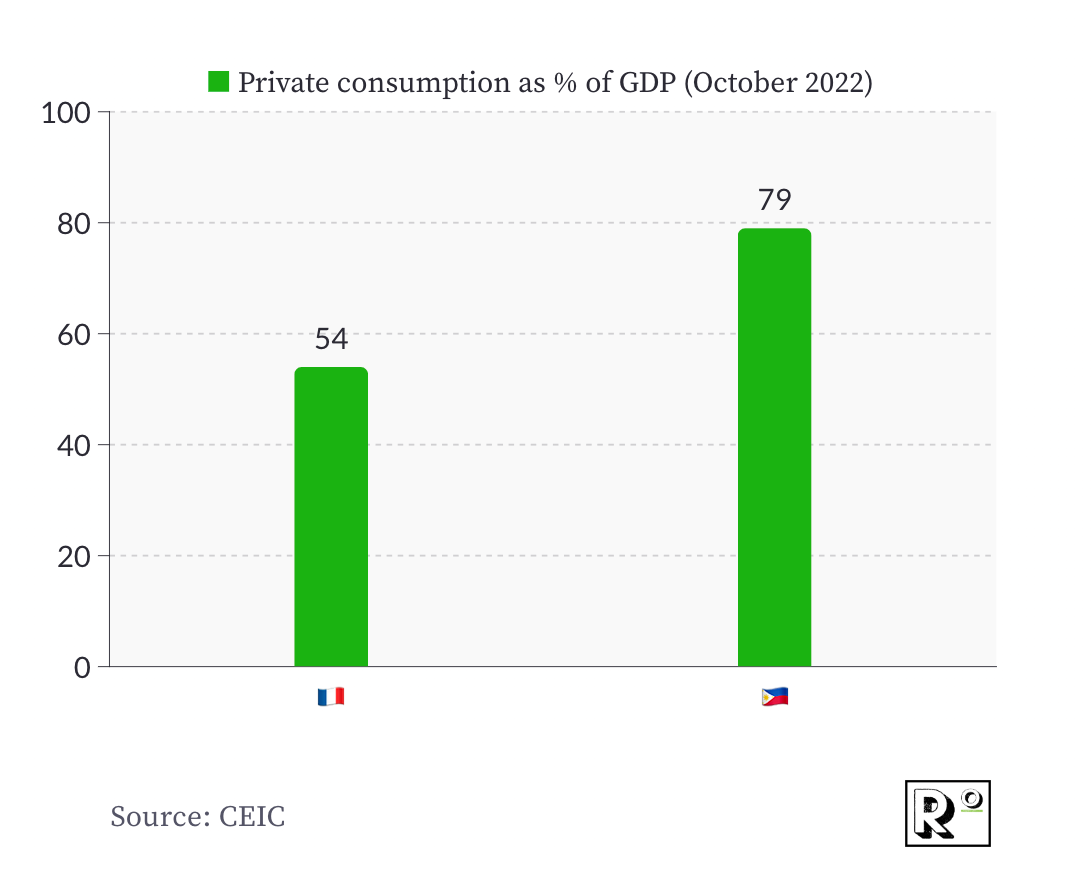

What I mean is that much of the Filipino economy runs on private, consumer spending rather than government capital injections. The government isn’t responsible for a lot of the spending domestically, in contrast to certain European countries for example.

That means that Filipinos are used to spending and being consumers. That provides an attractive market for new startups offering new products, physical or digital, combined with easier ways to pay. The growth of the Filipino middle class vindicates the market opportunity.

As I stated earlier, the digital economy is very new in the Philippines. The country was mainly analog just a decade ago. The growth in demand for these new digital goods and services isn’t slowing down any time soon.

Fintech and e-commerce have, obviously, dominated the first “Filipino startup wave”. What sectors do you see coming up next?

I think that consumer-driven startups will continue to dominate the landscape in the coming years, just because of the humongous demand that still needs to be filled. As for the next wave, the logical continuation of the ecosystem will be a shift to more B2B, SaaS products in sectors such as logistics or human resources.

On a more structural level, what are some of the measures that the Filipino government has taken to develop the startup scene?

The passing of the Innovative Startup Act in 2019 definitely played a role in providing somewhat of a structure to the ecosystem.

The launch of the $5M Startup Venture Fund and the Startup Grant Fund are both encouraging developments. The current government definitely has a stated interest to bolster the ecosystem’s development.

Laws on foreign ownership, which previously stipulated Filipino companies had to be majority-owned by Filipinos, are being changed. This could spur more foreign investment and foreign entrepreneurship within the country. There’s also a push to expand the ecosystem out of the capital and set up innovation centers in different regions across the country. Universities can serve as the anchorage for such initiatives.

The Iraqi ecosystem is also dealing with outdated foreign ownership laws

Despite the efforts, Filipino founders still face an overload of bureaucracy. It takes 45 days to open a business in the Philippines, which pales in comparison to Singapore where one can be up and running in a couple of business days. I know the Filipino government is working on a specialized entity to tackle that.

Final question: where can readers learn more about the ecosystem?

Foxmont recently released its 2023 Philippine Venture Capital Report. That should keep you busy for a while :)

The Realistic Optimist provides weekly, in-depth analyses of some of the most relevant stories in our now-globalized startup world. Subscribe below to receive it directly to your inbox and don’t hesitate to share it with your colleagues :)