Seedstars' masterplan to accelerate the first global generation of VCs

Seedstars has been at the forefront of the rapidly globalizing startup world for years. Their new endeavor has the potential to solve a lingering problem in emerging ecosystems.

The Realistic Optimist provides weekly, in-depth analyses of some of the hottest stories in our now-globalized startup world. Subscribe below to receive it directly to your inbox and don’t hesitate to share it with your colleagues :)

Disclaimer: This is not a sponsored piece. I verified the factual elements of the initiative with Seedstars, but I wasn’t restrained in my opinions.

Starting postulate

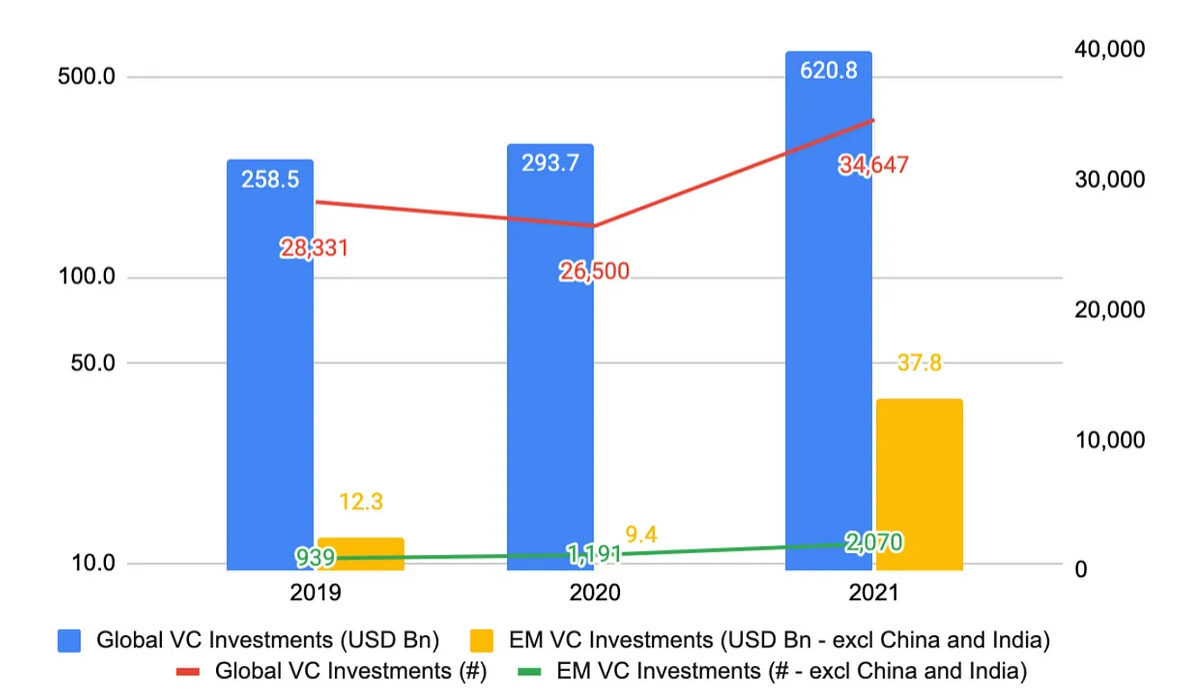

The past decade has witnessed the startup world’s globalization at a blistering pace. While previously pioneered and concentrated in North America, successful startups have recently sprouted worldwide, with unicorns now being founded in Brasilia, Paris, Lagos, and Jakarta. Many fail to realize just how quickly the paradigm has shifted.

In 2015, VC funding in Africa amounted to $277M. In 2022, it is on par to reach roughly $5B, translating to a 1,860 % increase. One can certainly make the argument that a drastic percentage increase always looks impressive when starting from a small number, a comment often made when discussing China’s drop in poverty rates for example. However, the fact of the matter still stands. Startups around the world, especially in emerging markets, have been exponentially growing and funded over the past decade.

The reasons for this exceptional rise lie in a couple of factors. The increase in global internet connectivity and the dire need for disruption in critical sectors such as financial infrastructure, health, commerce, education, and logistics have both created a powder keg of opportunity in emerging markets.

My own personal two cents is that the democratization of startup education online has also spread startup practices such as “being lean” or “iterating fast” worldwide. Whether in Beirut, Kuala Lumpur, or Belgrade, a first-time startup founder is likely to commence their startup education through Y-Combinator’s Youtube channel. This uniformization of startup best practices facilitates cross-border startup investing and dialogue.

“A Village Capital study suggested that out of 300 unicorn start-ups in the US, only 18% focused on health, food, education, energy, financial services, or housing—that number is well over 60% in all emerging markets.” - Source

As startup ecosystems emerge, they often clash with outdated local legislation, most prominently in key areas such as business registration, bankruptcy law, or stock option payouts. The ecosystem’s first founders are generally the ones doing the dirty work to smooth out the ride for future generations.

The other big point of contention for embryonic startup ecosystems is funding. More often than not, it isn't that the money itself is missing. Most countries have a fair amount of high net-worth individuals and institutional money stacked in banks or big corporations. Rather, what’s actually lacking is the knowledge and subsequent desire to invest in startups.

The way venture capital functions is unique, going against many of the principles traditional investors abide by. Venture capital involves putting all of your eggs in the same basket, and hoping for one to hatch golden while all of the others die. In nascent startup ecosystems, local investors are often turned off by the fact that they’ve never seen a locally bred golden egg, and aren’t willing to buy 100 eggs to find out.

What this ends up creating is a catch-22 situation, whereby local investors don’t want to invest in startups as they’ve never seen a successful local exit, and successful local exits don’t happen because no one is investing in local startups. In this piece, I explain that developed startup ecosystems such as the US, and increasingly Europe, solved this problem through the government pouring vast sums of money into the ecosystem.

This is a viable option, but multiple problems sprout once again. First, waiting for the government to kickstart the ecosystem takes decades, a timeframe unsuitable for impatient innovators. Second, governments in emerging markets might not be as effective as the ones leading the charge in the West, slowing down the process even more.

This brings us to the starting postulate for this article: how do you stimulate VC investment in nascent startup ecosystems, without relying solely on the government?

Seedstars: a backstory

Seedstars is a Swiss company that started as a global pitch competition in 2012, initially aimed at highlighting under-covered yet promising startups from emerging markets.

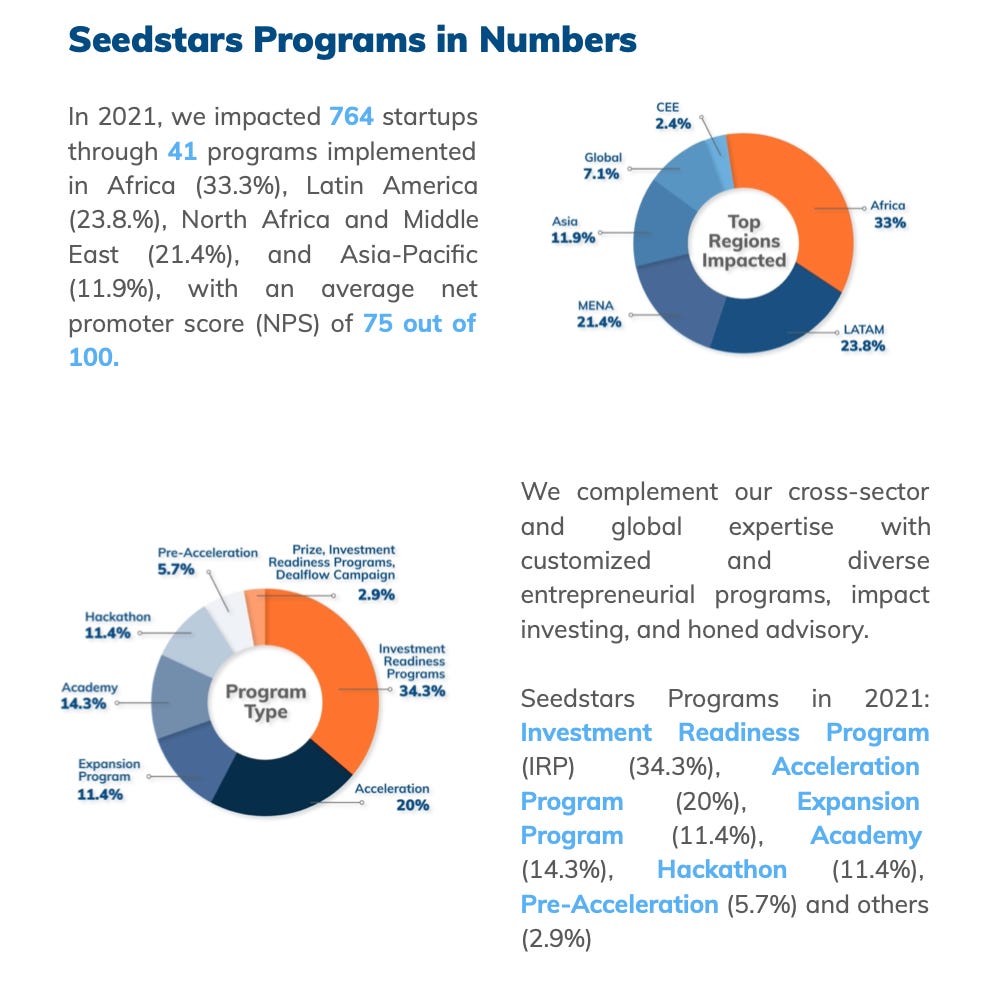

Throughout the years, Seedstars has morphed into one of the leading organizations dedicated to startup support worldwide, organizing competitions, launching incubators, and investing in startups from Azerbaijan to Peru. The company has been active in providing “full-stack” support to ecosystem development, advising new business angels on novel geographies, helping governments launch new initiatives, and getting corporates involved.

Today, the company is one of the most recognized in the field. Particularly interesting is the diversity of funding sources Seedstars is irrigated by, which results in a complex mosaic of different initiatives. Projects funded by foreign aid organizations go the way of startup education. Corporates sponsor Seedstars events. More traditional LPs trust Seedstars in its venture investing.

“Seedstars employs more than 100 people in 40 countries. On one side, we have around 100+ people supporting entrepreneurs, through programs we are operating and executing to enhance the development of local tech ecosystems. And on the other side, we have dedicated investment managers, each working for very specific funds with a unique investment thesis, which can invest in the top-performing companies in emerging and frontier markets.” - Alisée de Tonac, Seedstars co-founder

Seedstars Capital: Accelerating the new generation of VCs

As elucidated in the first paragraph, one of a nascent startup ecosystem’s paramount challenges is mobilizing local VC money. While we’ve already made the point that local founders have a hard time raising because local investors don’t believe in the VC asset class, the problem can be simplified even further: local startups have a hard time raising because there are little to no local VCs, an acute problem for seed / Series A startups that need capital to get off the ground.

Seedstars is taking a stab at this issue through its new aptly named initiative Seedstars Capital. In essence, the initiative’s mission statement is clear: accelerate and support the next generation of VC managers in emerging markets, just as they’ve done for startups over the past decade. I recently had the chance to chat with Benjamin Langer, the head of Seedstars Capital. Our conversation expounded a clearer view of what Seedstars Capital was, and what it wasn’t. In doing so, I’ve been able to formulate my own opinion about the topic and propose some points of discussion to consider.

A novel approach to a widespread problem

According to Benjamin, around 6% of global VC money is directed at emerging markets. Instead of trying to convince Western VCs to venture into startup hintherlands, Seedstars Capital takes a different approach by partnering and accelerating VCs based in those geographies. The objective is clear-cut: give GPs in emerging markets the boost they need to build their investment firms in order to, as Benjamin puts it, get them “institutional-money ready”.

More specifically, Seedstars targets early-stage funds led by locals, who intrinsically have a better understanding of the economy and culture. As Benjamin states, global actors provide great value for later rounds given their global networks and capital deployment capabilities, but local players make the most fitting early-stage investors.

“Local managers are exceptionally well-trained and experienced investors with large local networks and a strong desire to develop their ecosystems. We need the Blackrocks and Ontario Pension Funds of the world to invest in these ambitious, emerging-market based, VC funds to create more opportunities for local talent” - Benjamin Langer, Director at Seedstars Capital

To do so, Seedstars Capital is seeking to find the next generation of GPs in emerging markets. First-time or repeat GP both work, as long as the person has a demonstrated track record of thought leadership in the region and sector they seek to invest in. Previous managerial experience as a founder, angel investor, VC, or consultant, are also selection criteria. In short, Seedstars Capital isn’t targeting wide-eyed MBA grads, but people who have proven they can get things done. Seedstars is sector agnostic, but “we are looking for managers with unique theses and strategies” Benjamin clarifies.

Seedstars Capital is shooting to accelerate between 15 and 20 new funds across Latin America, Africa, the Middle East, Central/Eastern Europe, India and Southeast Asia. Each of these funds is aimed at having differentiated investment theses in order to avoid cumbersome overlap. While financed out of Seedstars’ own balance sheet to start with, Seedstars is betting on carry and management fees from the funds it accelerates to turn a profit in the long-run.

The startup accelerator model is the easiest analogy to visualize how it is envisioned to work. Seedstars Capital will pick and choose the GPs it wants to work with, based on the criteria described above. It will partner with them and provide these GPs with the co-branding rights, tech infrastructure, legal framework, deal flow, and all other resources needed to launch and scale a VC fund.

“We aim to create a network of early stage local managers that share best practises and deal flow and to provide managers with a global perspective and market data to improve the investment decision process” - Benjamin Langer, Director Seedstars Capital

In essence, Seedstars supercharges its GPs with all that the Seedstars network has to offer, right off the bat. Advice on charting an ESG framework, a constant in Seedstars’ activities, is also included.

Seedstars will act as a minority shareholder, contributing up to 5% of the fund size as an LP. The goal is to let the chosen GPs execute their strategies as they see fit. The first 5 funds, spanning 3 different continents, have already been selected and will be announced later this year.

Thoughts and challenges ahead

The idea behind Seedstars Capital is a cogent one. Not only does it address a potent issue in young startup ecosystems, but it also conceives a sustainable solution to said issue by sowing the seeds for the next generation of VCs in emerging markets. While I am a fervent adherent to the initiative, a couple of questions still linger on my mind.

“Insitutional-money ready”: Quesaco?

By saying they want GPs to be “institutional-money ready”, Seedstars really means that they are trying to get the VCs they accelerate to a gold standard in terms of quality of teams, soundness of investment thesis, portfolio construction strategy, and communication. At first, most of the money raised by the accelerated VCs will come from local investors such as family offices, with institutional money coming at later stages.

The question remains however. What will it take for the “institutional” money referenced by Benjamin to invest in the funds raised by the new VCs Seedstars accelerates? What will it take for Harvard’s endowment to invest $30M in a Sri Lankan VC? What will convince Blackrock to be an anchor investor in a Lagos-based first-time GP?

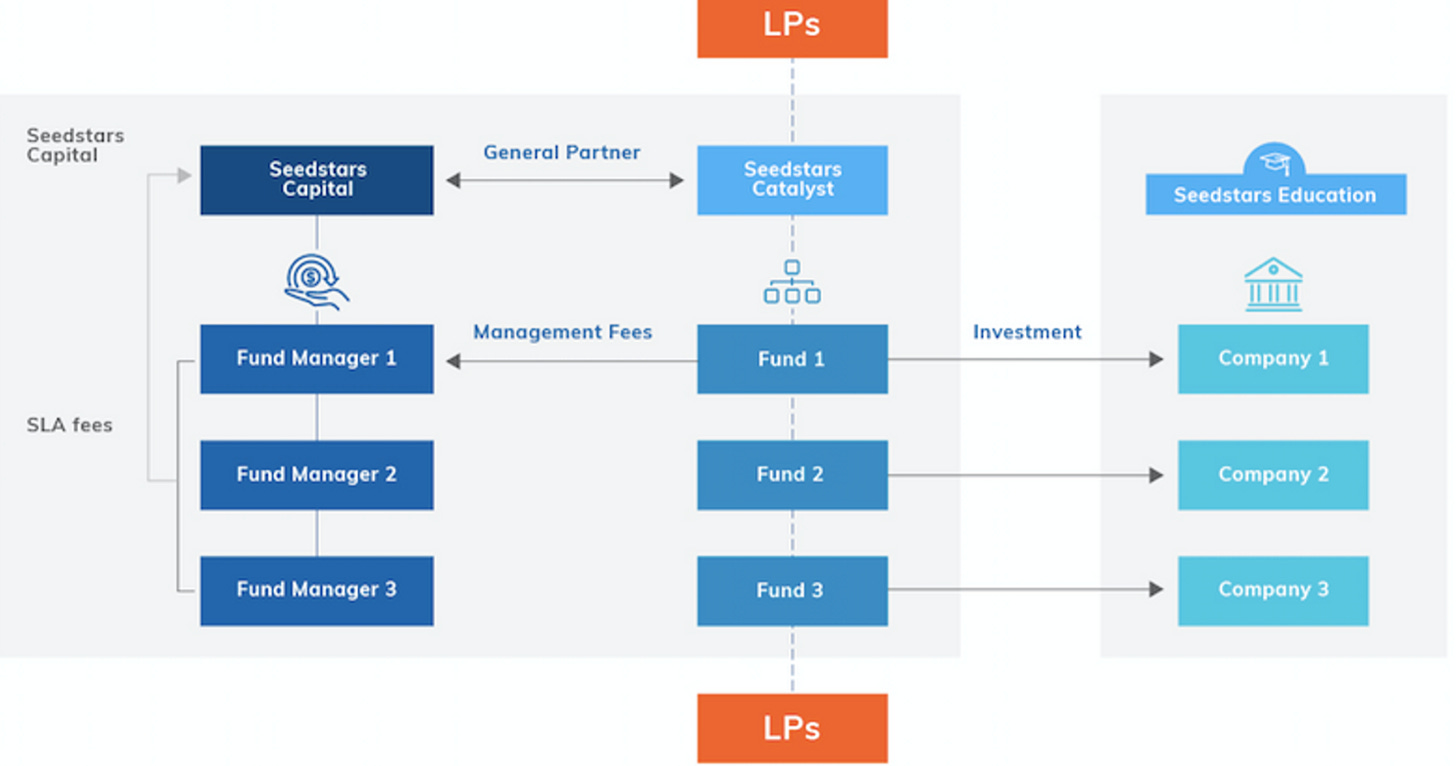

To mitigate risks and nudge these investments, Seedstars has launched the Catalyst investment vehicle, enabling institutional money to invest in all VC funds supported by Seedstars. This vehicle is offered at no cost to LPs (no management fee or carry) and aims to enable institutional money to have a clear diversification strategy, while also dipping their toes into new markets. I’ve included a visual explainer of the Catalyst vehicle below.

“We don’t envision Harvard's endowment to invest in a Sri-Lankan, Colombian or Moroccan fund. None of them are (today) big enough for them to make financial sense, it's also way too risky and concentrated. However, if you offer Harvard a way to invest in a diversified portfolio and to build a relationship with several emerging managers through Seedstars Catalyst, the value proposition is very different.” - Benjamin Langer, Director at Seedstars Capital

Dealing with governments

Second, what is Seedstars’ plan regarding the different governments it will have to deal with? Will it incentivize its GPs to form foreign structures or local ones? If the latter is chosen, what will they do if local laws aren’t up to par with the operational needs of a VC? How will Seedstars help their GPs mitigate mistrust about a particular market’s government?

Seedstars will help GPs set out their funds’ legal structures in Singapore, doing so under their existing VCC umbrella. This guarantees GPs’ technical ability to raise funds, but it won’t mitigate the problems portfolio founders face in the presence of unfriendly local legislation.

Governments can be both a formidable ally and a burdensome antagonist to a startup ecosystem depending on they approach it. One thing that’s for sure is that if Seedstars wants to help their VCs raise internationally, they will inevitably be faced with distrust regarding local governments. I am curious to see what contingency plan is in place regarding that topic.

Putting the carriage before the horse?

One of the more taboo topics when it comes to emerging market startup ecosystems is the lack of quality deals for VCs to invest in. While there is undoubtedly a lack in financing capabilities, some experienced VCs in nascent startup ecosystems point out that there are also not enough good startup deals to go around, due to the youth of the ecosystem and the fact that almost all founders are first-time founders.

While this fact is being rendered less and less relevant as ecosystems grow, is there a risk that Seedstars Capital accelerates too many VCs in markets where there aren’t enough quality startup deals to go around? This could end up creating an adverse situation whereby lack of quality deals indirectly leads these new VCs into mediocre deals, subsequently hurting their track record and their ability to raise institutional money, which is Seedstars Capital’s end goal after all.

According to Benjamin, “the need for additional early stage VC funding in most ecosystems is great. We need more and more diverse managers investing in local entrepreneurs. In that sense, more managers and funding creates more opportunities. However, the goal is always to deploy funds into the most promising ventures, not the ones available. The soundness of the investment thesis is therefore critical as is the relationship between the portfolio strategy and market depth.”

Maybe I’m biased because I’ve worked with small markets such as Palestine where there was a fundamentally limited amount of good deals to be made. Seedstars doesn’t seem to view this as an issue, resting on the fact that the VC funding gap in emerging gaps is so large that we are nowhere near saturation.

Concluding thoughts

Let’s tie in this conclusion with the starting postulate I outlined at the beginning of the article: how do you stimulate VC investment in nascent startup ecosystems, without relying solely on the government?

I believe Seedstars Capital provides an interesting hypothesis of how to do so, by accelerating the next generation of VCs in emerging markets instead of trying to incentivize reticent, incumbent Western VCs to widen their geographical horizons.

I’ve already outlined the functioning and my questionings about the initiative throughout the article. I’d like to dedicate this concluding paragraph to another topic which ties into the larger goal of me writing this newsletter: the dire need for discourse as the startup world globalizes.

I’ve now written more than 50 articles about startup ecosystems from Greece to Indonesia, success stories such as Nigeria’s Paystack and spectacular failures such as Pakistan’s Airlift. As I delve deeper and deeper into what I consider to be one of the most exciting times ever (ie: the democratization of startups worldwide) something constantly bugs me: the reluctance of local ecosystem players to public critique their ecosystem.

This is understandable: new startup ecosystems need to generate hype and excitement about their ecosystem in order to attract foreign money and talent. However, I find that this often comes at the expense of introspection about the problems facing the ecosystem, which can blindside and create disillusionment amongst foreign investors taking a stab at these new markets.

Previously taboo topics about emerging startup ecosystems need to be raised in order to bring the ecosystem forward. The utility of foreign aid money needs to be questioned. The disastrous management of so-called “ecosystem poster children” such as Egypt’s Capiter need to be openly discussed. The lack of quality deals, often resulting from a dearth of local talent, needs to be addressed. Governments need to be openly challenged on some of their reforms aimed at the startup ecosystem when those reforms aren’t as effective as they should be.

Publications such as TechCabal and Rest of World are finding the balance between openly critiquing what needs to be critiqued about these ecosystems and showcasing the incredible potential they hold. Having these trusted sources of analysis and intelligence about emerging market ecosystems is absolutely essential to generating foreign investors’ long-term interest in these new markets.

Yes, it’ll take longer than generating easy “hype” about these ecosystems, but it will avoid counter-productive situations whereby Western investors blindly buy into the hype of a new market just to get burned and vow to never return there.

Creating interest, not hype, will be essential for nascent startup ecosystems to attract foreign capital and talent. And to do so, an honest discourse, public disagreements and constant dialogue about the problems facing these ecosystems is needed.

The Realistic Optimist provides weekly, in-depth analyses of some of the hottest stories in our now-globalized startup world. Subscribe below to receive it directly to your inbox and don’t hesitate to share it with your colleagues :)