Biography

Rafa León is the co-founder of Mirlo, a Mexican startup positioning itself as a “digital telco”.

Mirlo sells phone plans to Mexican SMEs, and enables its clients to launch their own “voice AI” agents. Mirlo has raised a $1.5M pre-seed round led by Wollef.

Rafa is a repeat entrepreneur, founding multiple companies before Mirlo (in B2B software and e-commerce).

What problem is Mirlo solving?

Mexican SMEs, especially ones with high turnover (logistics, retailers…) struggle with their phone plans. The process of cancelling plans, buying new plans, assigning new numbers through traditional telco players is a pain. We wanted to create an easier, fully digital, streamlined experience. We’re inspired by what Nubank did to the banking industry.

Why is the telco experience for Mexican SMEs degraded?

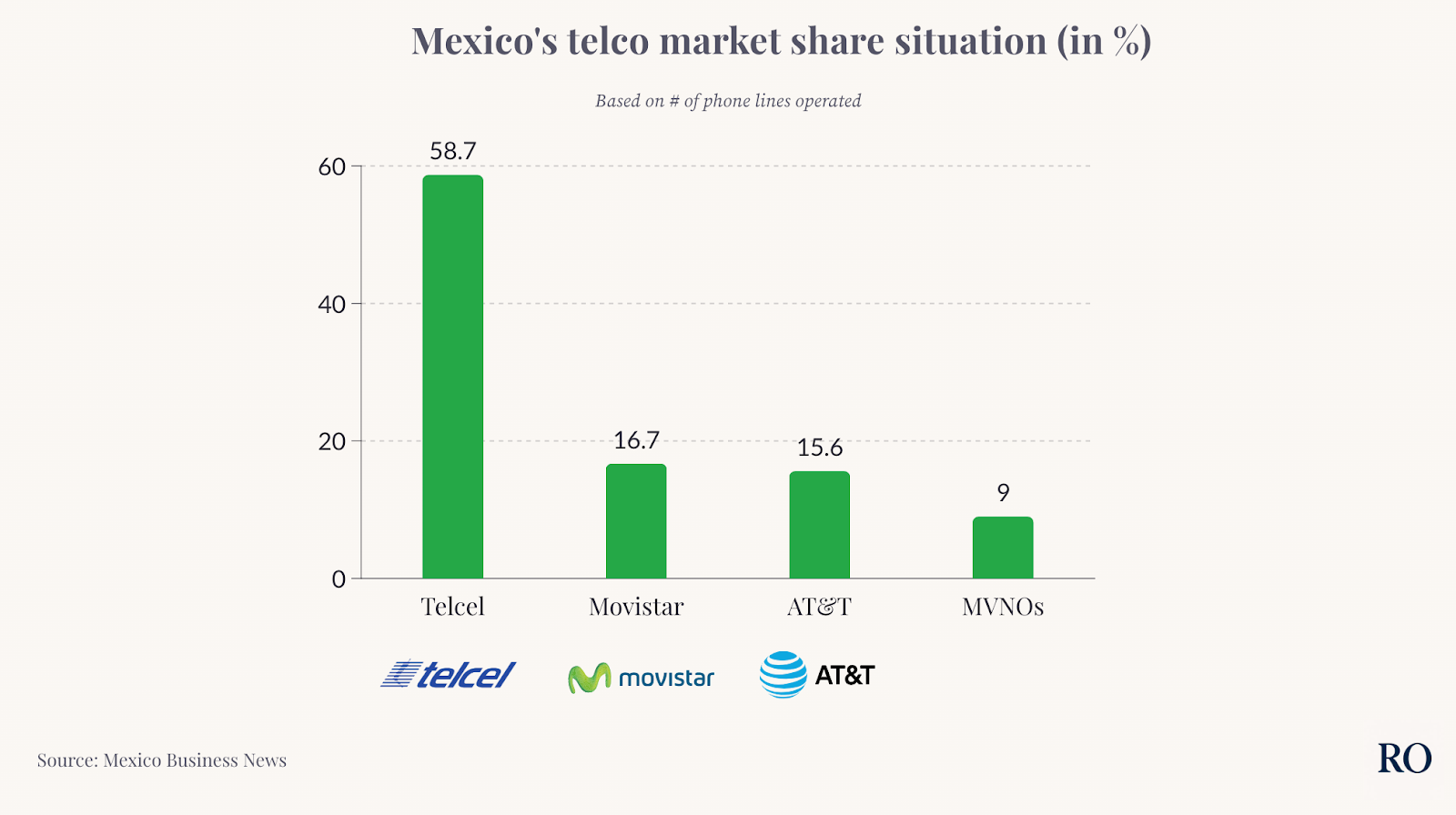

It’s a sclerotic market, dominated by a few incumbents. Competition is rough, but only between a few large companies.

We want to "decommoditize" the telco market. Instead of launching another telco service and competing on price, we want the telco service to be the base on which we layer on additional, premium services. This led us to launch an AI-agent product, which we’ll cover later.

While Mirlo’s service is fully digital, you need physical infrastructure to actually power the telco service. How have you gone about that?

Indeed. Mirlo needed an infrastructure partner to offer functional phone plans in the first place. We found a partner that specializes in the infrastructure part. They don’t sell plans themselves, but rather license their infrastructure to mobile virtual network operators (MVNOs) such as us. Economically speaking, Mirlo buys plans from that partner, resells them to its own customers, and takes a mark-up.

Source: Mexico Business News

RO insights: building in CAPEX-heavy industries, without the CAPEX

A startup competing in the telco industry sounds expensive. Does that mean they have to set up an entire telephone pole infrastructure?

What Mirlo has done is different: they operate a tech, UX layer but “buy” infrastructure from a third-party. If their tech and UX is good enough, they can take a markup on what they pay for infrastructure.

A similar proxy is solar panel startups. Many startups “sell” solar panels but don’t actually manufacture them. Instead, they focus on improved customer service and UX, sometimes layering on financing as an additional value proposition.

Managed marketplaces are an example of such a model.

Here’s how Rotimi Thomas, co-founder of Nigerian startup SunFi, explains his model:

“We buy solar solutions from installers, sell them to end clients and enable them to pay in installments. The installer who we purchased from takes care of the installation, but we oversee their relationship with the client. If a client has an issue, we’re their single point of contact. We redirect relevant demands to installers ourselves.

Clients have the choice between two payment plans. One is a “lease-to-own” plan, where they own the solar panels at the end of their repayment period. The other is “solar-as-a-service” where the client “leases” solar panels for a monthly fee.

What’s important to note here is that we’re not lending anyone money. We don’t send money to customers. We sell them a real-world asset, oversee its quality and installation, and enable them to pay in installments. We’re a textbook example of a managed marketplace.

The other side of our product is that we act as solar installers’ digital back-office. Through our platform, installers can keep track of the different clients they’re serving, manage the different products they offer, access various business analytics…”

Excerpt from SunFi: managed solar marketplace in Nigeria, originally published in The Realistic Optimist

What did your MVP look like?

Once the infrastructure partnership was in place, we focused on a single thing: make it easy for Mexican SMEs to buy and manage phone plans for their employees.

This isn’t your first entrepreneurial rodeo. What choices have you made in Mirlo that were inspired by your previous endeavors?

First, we focused on getting revenue from day 1. We don’t offer a free trial or a free plan. You’re either a paying customer or we don’t serve you. I’ve learned that the best way to measure if your company is doing well is whether users pay you.

Second, we spent a lot of time honing in on our ICP. We settled on that high-turnover, SME type that struggles with their employees’ phone plan management.

What is your relationship with incumbent telcos?