Biography

Luni Libes is the CEO and co-founder of Africa Eats, an investment company investing in African SMEs. The Africa Eats portfolio consists of 22 companies operating at various levels within the food and agricultural value chain.

Africa Eats’ portfolio companies currently operate in eight countries, including Kenya, Uganda, Rwanda, Tanzania, Malawi, Ghana, Ethiopia, and Zambia, with additional exports to neighbouring countries. Africa Eats raised over $11M, primarily from family offices.

As of December 2024, Africa Eats is publicly listed on the Mauritius stock market. Prior to Africa Eats, Luni founded and operated Fledge, a global business accelerator.

Preamble:

This is a special Realistic Optimist piece. Luni is neither a (current) startup founder, nor a VC. But the way he structured his investment company holds valuable insights for VCs globally questioning the classic “10+2” model, especially in ecosystems where liquidity is scarce.

You’re not African. What’s Africa Eats’ genesis?

I previously founded Fledge, a global business accelerator. We made investments worldwide, and realized that Africa was the geography where our investees had the most trouble raising follow-up funding. Africa Eats is a spin-off from Fledge, geared towards addressing that problem.

Africa Eats’ structure mixes various investment philosophies. Can you elaborate?

We take the VC philosophy of keeping minority equity ownerships and letting founders run the show. You need them to do exceptional things, so they need skin in the game, which is why they need to maintain majority ownership.

From the business accelerator, we take the community aspect. Most VCs say they ‘add value’ but many haven’t ever built a business. Y-Combinator’s most valuable component is the network of fellow YC founders one can tap at a moment’s notice. We get Africa Eats’ founders to communicate with each other as much as possible, flying them into Nairobi to physically meet once a year. This network effect and its associated value compounds over time.

Finally, we take the Berkshire Hathaway stance that the best holding period is forever. We want to fund great African SMEs early, and stay along for the ride as long as possible.

Africa Eats invests in African SMEs focused on food production or improving the agricultural supply chain. Why that thesis?

First, because those were the types of companies we used to work with with Fledge. Second, because Africa needs more food production and people can’t eat software. Additionally, Africa suffers from fragmented internal supply-chain issues that lead to food-waste and a need to import food from abroad. We wanted to fund companies solving these issues.

A lot of African startups serve the emerging, digitally-savvy African middle class. And don’t get me wrong: there are huge opportunities there and great companies to build, notably in fintech. But at the end of the day, you also need a society’s basics to be covered.

Via which investment type do you fund companies?

We buy equity but we also try to be useful beyond that. We can extend a punctual loan or match a grant when required.

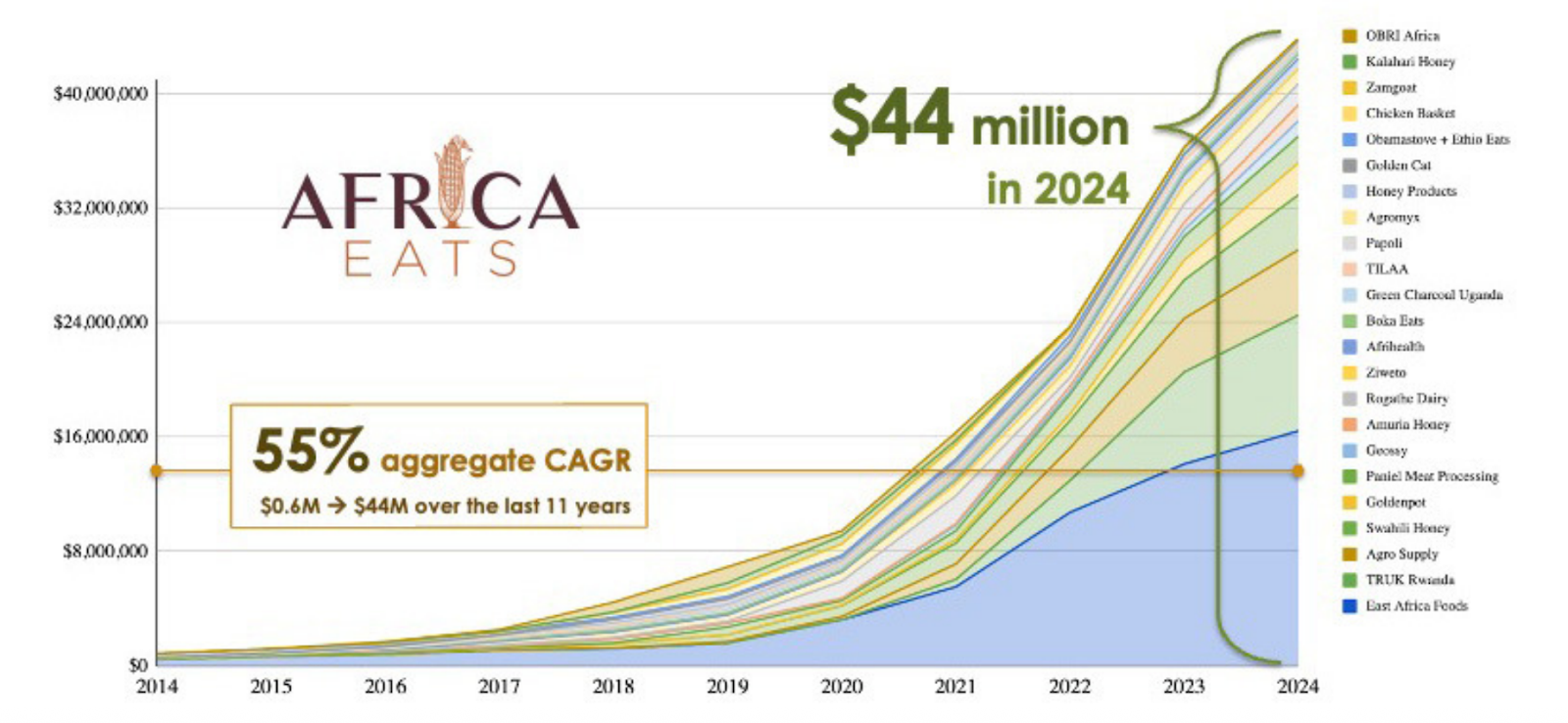

Aggregate yearly revenue of Africa Eats’ portcos

Source: Africa Eats 2024 report

You’ve publicly listed Africa Eats on the Mauritius Stock Exchange (SEM) a little less than a year ago. Why?